Your Success Story Starts Here

Advance your career with tailored growth strategies, expert support, and innovative tools that drive success.

Support That Sets

Us Apart

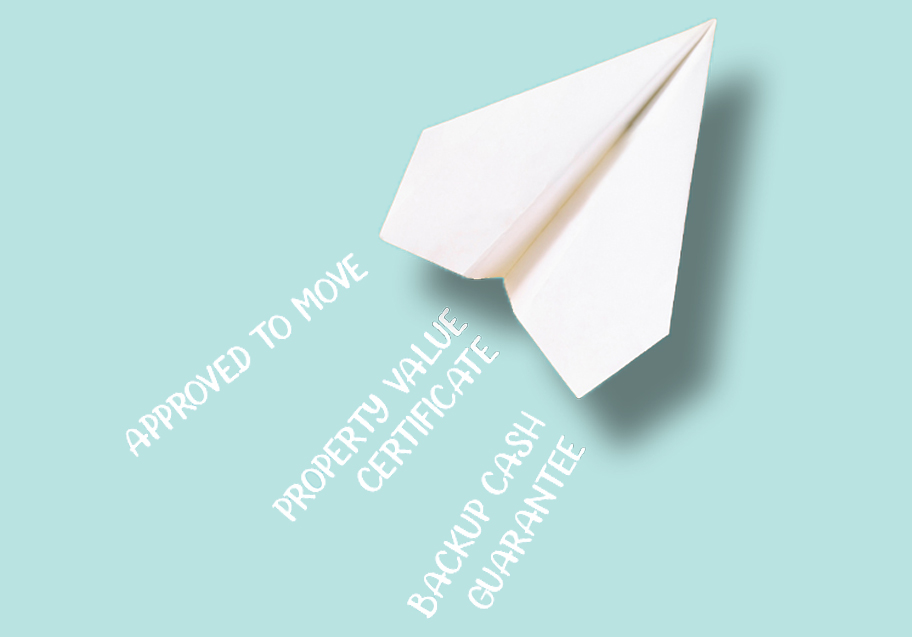

Proprietary products

Approved to Move

Get a fully underwritten approval — before finding a property — that’s virtually as good as a cash offer

Property Value Certificate

We certify the property’s value so buyers can choose to waive the appraisal contingency

Approved to Close Backup Cash Guarantee

Buyers can choose to waive both financing and appraisal contingencies and give the seller a backup cash guarantee

Team-centric approach

Join a supportive, collaborative community where your ideas are valued.

You’ll enjoy an open-door policy with top management, along with weekly sales calls that keep you not just informed but involved.

Here, every loan officer has a voice and is empowered to grow.

Your roadmap to success

Personalized growth plan

After discussing your goals together, you’ll receive a customized JumpStart plan with steps and strategies to maximize earnings and market reach.

Continuous coaching & job training

Engage in weekly collaborative coaching sessions and targeted learning, such as Communities of Practice, to sharpen your skills and drive growth.

Professional marketing

In-house expertise

You’ll have a full-service marketing team promoting your brand and generating leads around the clock. Enjoy everything from digital ads to event management to co-branded web pages.

60% expense reimbursement

We don’t just provide industry-leading support — we pay for it, too. We’ll cover 60% of your marketing costs.

Dedicated experts

Local advantage

Processors, underwriters, and closing teams are local to ensure faster, more efficient loan processing.

Specialized service

Enjoy access to non-QM and broker desk experts who find solutions for complicated loans to reduce delays and improve outcomes.

You’re a VIP

From Day One

Before you even set foot at Embrace, we handle your licensing, introduce you to your support team, and fly you to our headquarters for four days of VIP treatment and hands-on training.

Welcome & discovery

- Begin your adventure with personalized onboarding and travel coordination.

- Receive a welcome package with essential tech and marketing tools to hit the ground running.

Seamsless transition

- Experience our “Orange Carpet” orientation during your first week, with dedicated one-on-one support.

- Set up essential technology, complete licensing and loan transfers, and receive hands-on training.

Trajectory to success

- Begin customized training programs and advanced tech sessions from week two onward.

- Join ongoing coaching calls and personalized marketing strategy sessions designed to elevate your sales game.

How We Stand

Out

At Embrace, we’re not just about mortgages, we’re about making homeownership personal, accessible, and extraordinary.

98%

Customer satisfaction means more referrals.

19-year

Average executive tenure ensures stable leadership.

Classic Mortgage Solutions Stack Your Success

Leadership That Truly Listens

We’re committed to fostering a culture where your thoughts and ideas are important.

Al Dussinger

Chief Operating Officer

Build the business you’ve always envisioned

At Embrace, we combine tools, coaching, and real support to help you grow smarter, move faster, and win bigger — your way.

Technology For Growth

Frequently asked questions

Embrace reimburses 60% of your marketing expenses and provides access to a full-service marketing team that handles digital ads, social media, events, and custom strategy—all designed to grow your business.

Our onboarding process begins before your first day and includes licensing support, tech setup, and hands-on training. Most loan officers are ready to originate within a couple days.

Our culture, core values, and commitment to innovation set us apart. From direct access to leadership to our team-centric environment, we empower every loan officer to thrive.

We offer competitive compensation, performance incentives, and a comprehensive benefits package that supports both your professional success and personal well-being. Benefits include medical, dental, vision, life insurance, 401(k) plans, flexible spending accounts, employee assistance programs, and more.

Embrace Home Loans is an independent mortgage lender with a long-standing track record of stability and growth. We specialize in personal, accessible lending experiences and have grown into one of the country’s fastest-growing home lenders. We maintain our headquarters in Middletown, Rhode Island and continue to expand our reach along the East Coast.

Ready to Accelerate Your Career?

Get started with a custom growth plan:

- Tailored roadmap to accelerate your career

- One-on-one coaching for every step

- Innovative tools to drive your success

Jumbo loans

Jumbo loans